Posts Tagged ‘income tax’

What impact will tax reform have on you?

Contrary to a front-page story in a major Mississippi newspaper, the phase-down of Mississippi income taxes will not begin until January of next year. The new law setting that phase-down in motion technically took effect July 1, the usual date each year for new laws to actually become law. But changes in tax laws usually…

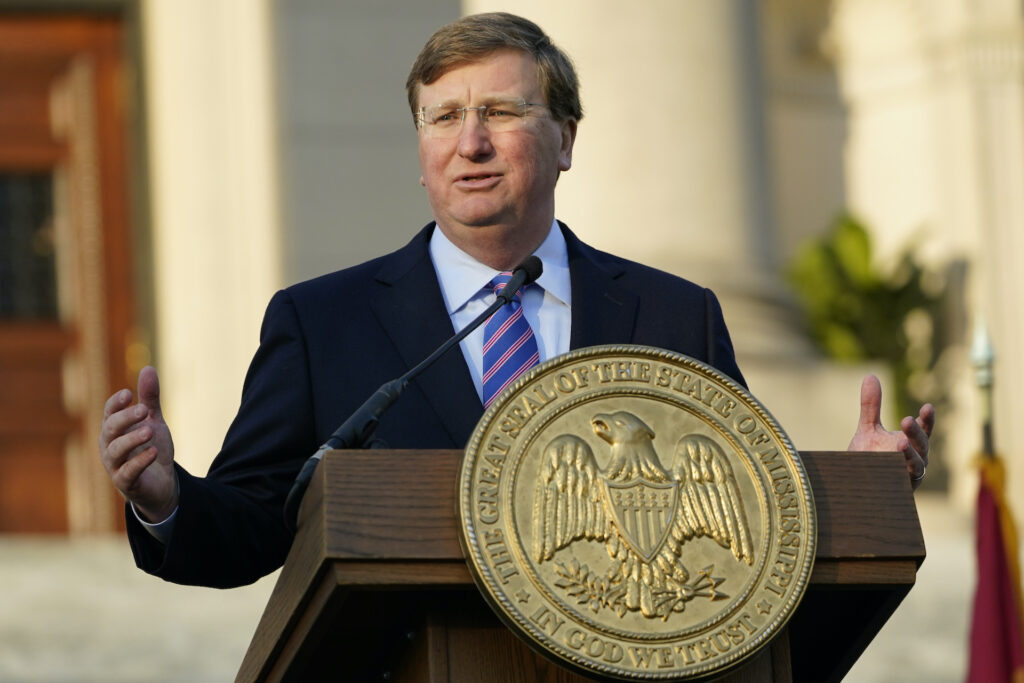

Read MoreGov. Reeves enters the field with bold plan to eliminate income tax

With just three days to go before a final deadline to agree to a tax reform proposal in this legislative session, Gov. Tate Reeves has proposed a plan to fully eliminate the income tax within eight years. Under Reeves’ proposal, Mississippi would create a flat tax of 3.5 percent in the first year of the…

Read MoreStates with lowest taxes are growing

A new report details how states with the best individual tax climate are also growing at among the fastest clips in the nation. Unfortunately for Mississippi, the state doesn’t rank highly and it, not shockingly, continues to lose population. The Tax Foundation individual income tax component of their 2022 State Business Tax Climate ranks Alaska,…

Read MoreHouse adopts latest income tax repeal proposal

As we get to the last few days of the session, the House is bringing forward a new proposal to eliminate the income tax. The newest proposal is a $100 million buy down of the income tax rate until it has been eliminated. Speaker of the House Philip Gunn noted that is 1.5 cents on…

Read MoreClock is ticking for Mississippi legislature

The 2022 legislative session is headed down the home stretch with several major pieces of legislation hanging in the balance. Among the big items still to be resolved in the next week and a half are legislative redistricting, passing a spending plan for the $1.8 billion in federal funds allocated to Mississippi by Congress under…

Read MoreIndiana drops income tax to under 3%

Indiana Gov. Eric Holcomb has signed legislation that will drop Indiana’s flat income tax to under 3 percent. The state’s current 3.23 percent rate will gradually drop to 2.9 percent over a period of seven years. Indiana already had one of the lowest income tax rates in the country. They will soon have the lowest…

Read MoreMajor changes to tax plans in both chambers

Both the House and Senate were busy advancing heavily amended tax relief proposals in advance of yesterday’s deadline for action. Both chambers voluntarily moved closer to each other, though the chasm between the two is still wide with only a few weeks left in session. On Monday, the House took Senate Bill 3164 and inserted…

Read MoreHouse and Senate keep income tax relief alive

Both the House and Senate advanced amended tax relief proposals this week, keeping the issue alive as lawmakers near the end of the session. “To the credit of both the House and Senate, each side moved closer to the other,” Russ Latino, president of Empower Mississippi said. “They could have easily inserted their original language…

Read MoreHouse and Senate keep income tax relief alive

Today, both the House and Senate amended income tax proposals, keeping them alive as the session continues. In the House of Representatives, the House Ways & Means Committee amended Senate Bill 3164 to include an income tax phase-out without a sales tax offset. In exchange for not including an offset in sales tax, the amount…

Read MoreWhere does income tax repeal stand?

The legislature now has 3 weeks left on the calendar, with a considerable amount of work left before Sine Die. No bill is bigger – or more significant and impactful – than efforts to repeal the income tax. Here is where things stand. Back in early January, the House passed out a plan to immediately…

Read MoreBusiness leaders call for income tax repeal

A large group of business leaders sent a letter to Gov. Tate Reeves, Lt. Gov. Delbert Hosemann, and Speaker Philip Gunn calling for income tax repeal yesterday. “As business leaders, we recognize the economic challenges facing our state, many of which have persisted for generations. To leap forward, we need a bold paradigm shift—one that…

Read MoreStates continue to reduce taxes

States have not slowed down in their quest to lower tax rates a year after we saw a dozen states take action. The latest is Iowa, which will drastically reduce its top income tax rate from 8.53 percent, one of the highest rates in the country, to a 3.9 percent flat rate by 2026. Here’s…

Read More