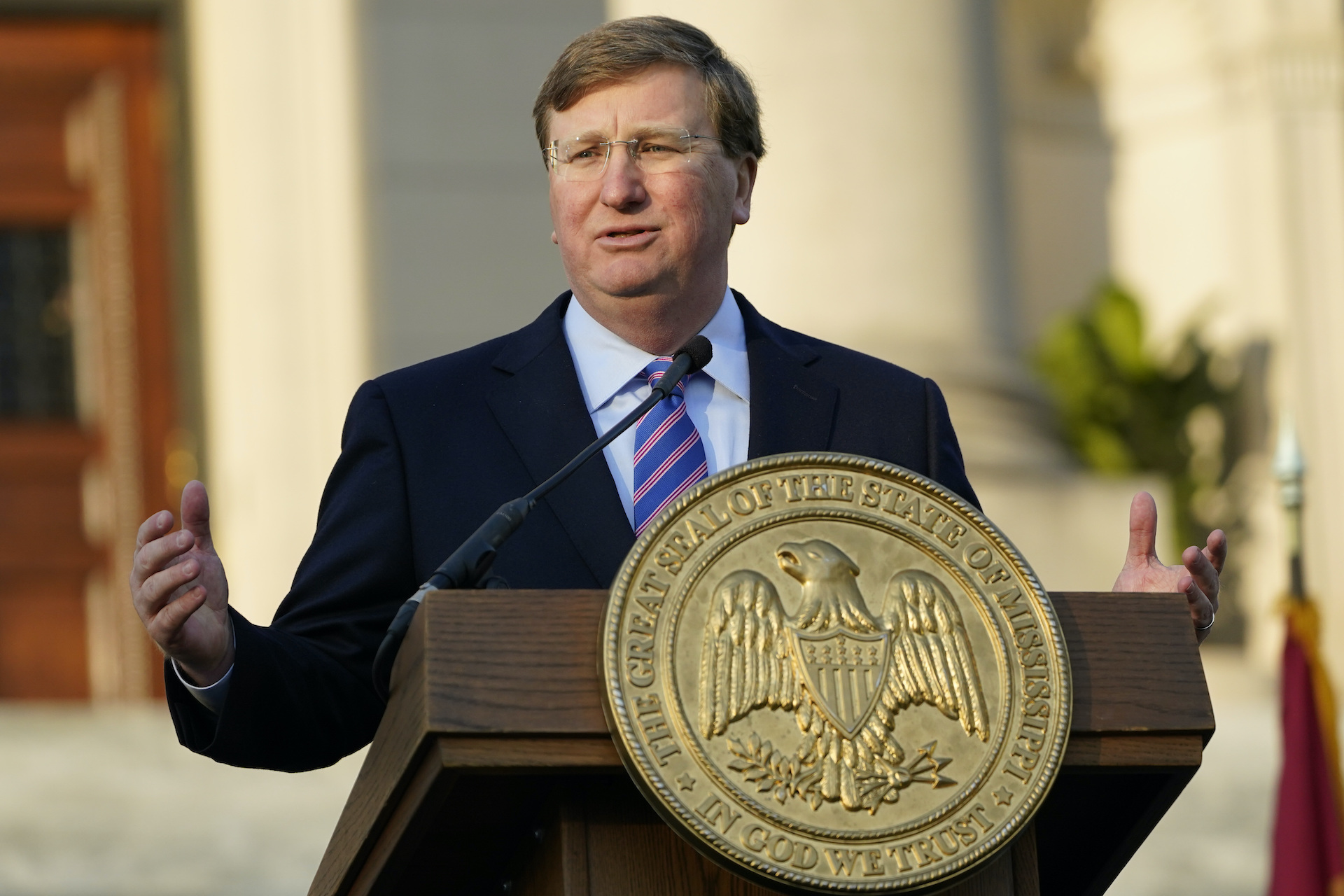

Reeves reiterates call for income tax elimination

Gov. Tate Reeves called for a bold vision in his push for elimination of the income tax during his annual State of the State address tonight.

“We also need to consider how to attract those companies and economic projects that transform communities—create generational wealth and lift families out of poverty,” Reeves said. “This does not just happen one project at a time. It takes a bold vision that lasts forever. The heart of that vision is the elimination of the state’s income tax.

“By eliminating the income tax, we can put ourselves in a position to stand out. We can win those projects. We can throw out the welcome mat for the dreamers and the visionaries. We can have more money circulating in our economy. And it can lead to more wealth for all Mississippians.”

This has long been a position of Reeves, and it was included in his 2023 Executive Budget Recommendation that was released last fall.

Reeves also noted the income tax repeal plan that passed the House two weeks ago.

“I know that many of you have already demonstrated an appetite for such boldness, and I want to thank you,” Reeves added. “In the House, Republicans and Democrats voted overwhelmingly for their chamber’s bipartisan tax plan, which would eliminate the income tax. Speaker Gunn and Chairman Lamar, thank you for your hard work and your commitment to this ongoing effort. If we can eliminate the income tax, we will achieve an historic victory for this state. We can become a place that money flows more freely, and all Mississippians will benefit.”

Under the House plan, the mechanism for repeal begins by raising the personal exemptions to $37,700 for single workers and $75,400 for married workers. The remainder of the income tax elimination would occur in subsequent years by allowing for a reasonable rate of growth in government spending, 1.5 percent, but applying any revenue collected over that rate of growth to increase the exemption until the tax was completely repealed.

Empower has spent two years building the case for income tax repeal, which culminated in a report last year that provides dynamic modeling under two scenarios for eliminating the income tax, a comparative analysis that demonstrates that states without income taxes can both sustain reasonable government spending and thrive economically, and some policy considerations for lawmakers weighing transformative tax reform.