How would income tax repeal impact you?

The Mississippi House of Representatives has adopted legislation designed to eliminate the state’s income tax.

How does it work?

In year one of the plan, the exemption available to income tax filers would go up to $37,700 for single filers and $75,400 for married filers. This means that for most Mississippi workers, the income tax would be completely eliminated in the first year. It’s a roughly billion-dollar cut that is partially offset by a 1.5 percent raise in the general sales tax, estimated to produce $750 million in tax revenue. The remainder of the year 1 cut is “paid for” with large surpluses the state is experiencing. In subsequent years, the income tax exemption will be expanded using something called a “growth trigger” or “fiscal rule.”

Under the current proposal, any growth in revenue that exceeds 1.5 percent annually will be applied to increasing the exemption until the tax is completely eliminated. As an example, let’s say you spent $50,000 in 2021. Applying a similar fiscal rule to your budget, you’d be allowed to spend $50,750 in 2022. Any earnings over that would be put in savings, or in the case of this bill, returned to the taxpayer. This allows for a reasonable rate of growth, but also a limit on government spending. For a point of reference, over the last decade, Mississippi government grew at a rate nearing 4 percent a year.

In addition to the income tax relief, the Tax Freedom Act, if enacted, would reduce the grocery tax to 4 percent and offer a credit of 50 percent on Mississippi car tags, which are presently the third most expensive in the nation.

So how would this impact individual people?

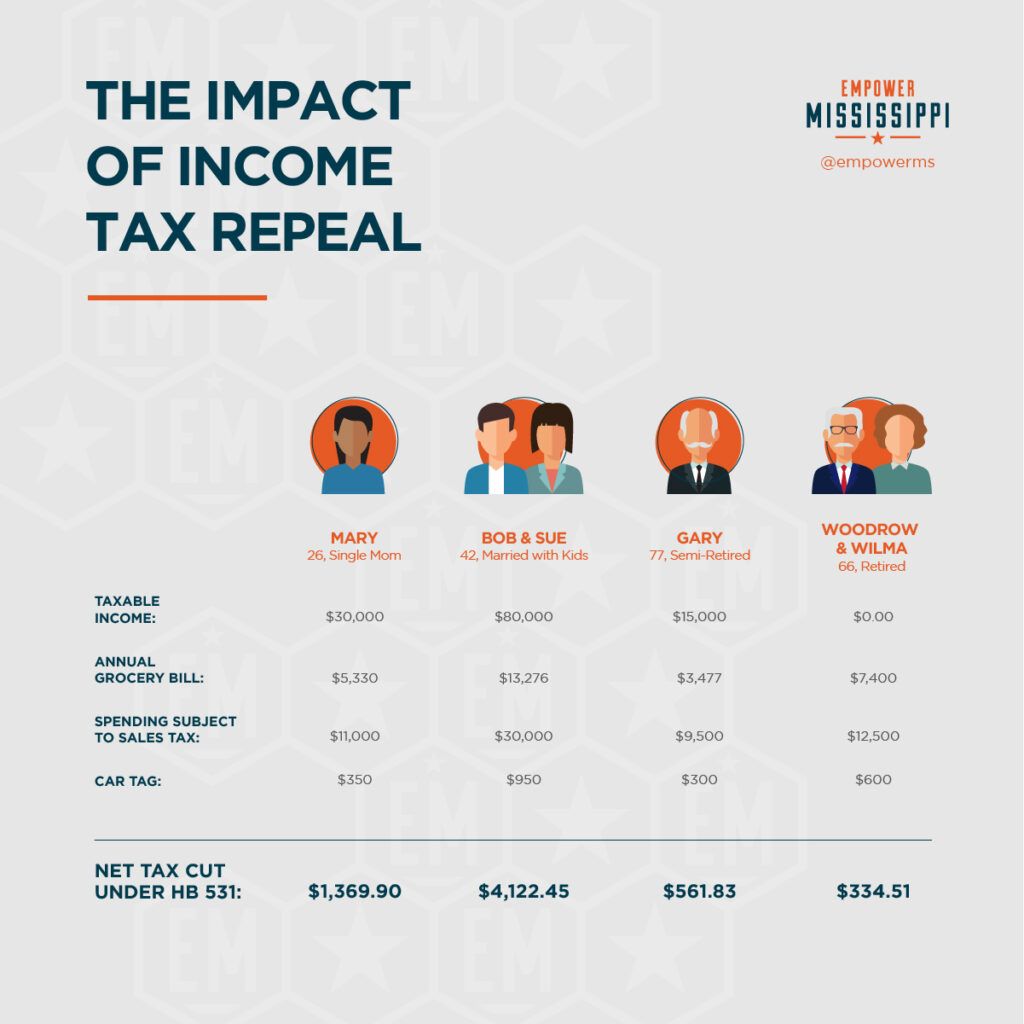

If HB 531 were to pass, here is what the net tax cut would look like for various people.

Meet Mary. Mary is a Mississippi resident. She’s twenty-six, single, and has a four-year-old daughter named Margaret. Mary has $30,000 in taxable income under Mississippi’s current law and pays $1,200 annually in income taxes. She buys $5,330 worth of groceries for her and Margaret every year, paying $373.10 in sales taxes on those purchases. In addition to buying groceries, Mary spends $11,000 a year on purchases subject to Mississippi’s 7 percent sales tax, good for $770.00 in taxes. Mary pays $350 a year for her car tag.

If Mississippi’s income tax were eliminated, the grocery tax was cut to 4 percent and a 50 percent credit were available for her car tag, Mary would be able to keep the $1,200.00 she currently pays in income taxes, would save $159.90 annually on grocery taxes, and would save $175 on her car tag. If to accomplish the income tax elimination and grocery tax reduction, the sales tax rate was increased to 8.5 percent, Mary would pay an additional $165.00 in sales taxes. The net tax reduction to Mary would be $1,369.90.

Net Tax Cut Under HB 531: $1,369.90

Meet Bob and Sue. Bob and Sue are Mississippi residents and in their forties. They are married with two children, Billy and Sally. Together, they have taxable income of $80,000 under Mississippi’s current law and pay $3,700 annually in income taxes. They buy $13,276.80 worth of groceries every year and pay $927.38 in grocery taxes on those purchases. In addition to buying groceries, Bob and Sue spend $30,000 a year on purchases subject to Mississippi’s 7 percent sales tax, good for $2,100 in taxes. Combined, Bob and Sue pay $950 a year for their car tags.

If Mississippi’s income tax were eliminated, the grocery tax was cut to 4 percent and a 50 percent credit were available for their car tags, Bob and Sue would be able to keep the $3,700 they currently pay in income taxes, would save $397.45 annually on grocery taxes, and $475 on their car tags. If to accomplish these changes the sales tax rate was increased to 8.5 percent, Bob and Sue would pay an additional $450.00 in sales taxes. The net tax reduction to Bob and Sue would be $4,122.45.

Net Tax Cut Under HB 531: $4,122.45

Meet Gary. Gary, 72, is a Mississippi resident. He is a widower who lives off of a wide array of retirement income that includes 401(k) retirement savings, Social Security, a part-time job, and a few rental properties. Gary’s side income and rental properties bring in $15,000 in taxable income, on which he pays $450.00 a year in income taxes. Gary buys $3,477.60 worth of groceries every year and pays $243.43 in sales taxes on those purchases. Like most seniors, Gary’s spending is more concentrated on health care and items that are not subject to sales taxes, but in addition to groceries, he still spends $9,500 a year on purchases subject to Mississippi’s 7 percent sales tax, good for $665 in taxes. Gary pays $300 a year on a car tag.

If HB 531 passed and Mississippi’s income tax was eliminated, the grocery tax was cut to 4 percent, and a 50 percent credit were available for his car tags, Gary would be able to keep the $450 he currently pays in income taxes, would save $104.33 annually on sales tax paid on groceries, and $150 on his car tag. If to accomplish these changes, the sales tax rate was increased to 8.5 percent, Gary would pay an additional $142.50 in sales taxes.

The net tax reduction to Gary would be $561.83. In order for HB 531 to be neutral or result in a tax increase, Gary would have to increase spending subject to the general sales tax to $46,915.33 or more.

Meet Woodrow and Wilma, each in their late 60s, recently retired, and residents of Mississippi. Woodrow and Wilma are living entirely off of retirement income and pay no income taxes. They buy $7,400.40 worth of groceries every year and pay $518.03 in sales taxes on those purchases. Like Gary, they pay no property taxes thanks to Mississippi’s homestead exemption for seniors and pay no sales taxes for their medicines, which take up a higher percentage of their total spending. Apart from groceries, Woodrow and Wilma spend $12,500 a year on purchases subject to Mississippi’s 7 percent sales tax, good for $875 in taxes. Woodrow and Wilma pay a combined $600 for car tags annually.

If HB 531 were passed and Mississippi’s income tax was eliminated the grocery tax were cut to 4 percent and a 50 percent credit were available for their car tags, Woodrow and Wilma would save $222.01 annually on sales tax paid on groceries, and $300 in savings on their car tags. If to accomplish these changes, the general sales tax rate was increased to 8.5 percent, they would pay an additional $187.50 in sales taxes.

The net tax reduction to Woodrow and Wilma would be $334.51. In order for HB 531 to be neutral or result in a tax increase, the couple would have to increase spending subject to the general sales tax to $22,300.67 or more.